U.S. October 2020

Copyright © 2008-2020 American Express Travel Related Services Company, Inc. All rights reserved.

Table of Contents

1 Introduction

1.1 About American Express

1.2 About the Reference Guide

1.3 Organization of the Reference Guide

1.4 Publishing Schedule

1.5 Becoming an American Express Merchant

2 Doing Business with Ameriacan Express

2.1 Introduction

2.2 The American Express Merchant Number

2.3 Merchant Information

2.4 Use of Third Parties

2.5 Compliance with the Technical Specifications

2.6 Call Monitoring

2.7 Permitted Uses

2.8 Cardmember Offers

2.9 Marketing Programs

3 Card Acceptance

3.1 Accepting the Card

3.2 Treatment of the American Express Brand

3.3 Prohibited Uses of the Card

3.4 Treatment of American Express Cardmember Information

4 Transaction Processing

4.1 The Many Types of Transactions

4.2 Transaction Process

4.3 Completing a Transaction at Point of Sale

4.4 Processing an In-person Charge

4.5 Customer Activated Terminals

4.6 Processing a Card Not Present Charge

4.7 Processing a Credit

4.8 Digital Wallet Payment

4.9 Return and Cancellation Policies

4.10 Corporate Purchasing Card Charges

4.11 Advance Payment Charges

4.12 Aggregated Charges

4.13 Delayed Delivery Charges

4.14 Recurring Billing Charges

4.15 Processing Prepaid Cards

4.16 Processing Travelers/Gift Cheques

4.17 Property Damages to Accommodations and other Rentals

5 Authorization

5.1 Introduction

5.2 Transaction Process

5.3 The Purpose of Authorization

5.4 Authorization Process

5.5 Possible Authorization Responses

5.6 Obtaining an Electronic Authorization

5.7 Obtaining a Voice Authorization

5.8 Card Identification (CID) Number

5.9 Authorization Reversal

5.10 Authorization Time Limit

5.11 Floor Limit

6 Submission

6.1 Introduction

6.2 Transaction Process

6.3 Purpose of Submission

6.4 Submission Process

6.5 Submission Requirements – Electronic

6.6 Submission Requirements – Paper

6.7 How to Submit

7 Settlement

7.1 Transaction Process

7.2 Settlement Amount

7.3 Discount/Discount Rate

7.4 Method of Payment

7.5 Speed of Payment

7.6 Payment Options

7.7 Reconciliation Options

7.8 Payment Errors or Omissions

8 Protecting Cardmember Information

8.1 Data Security Operating Policy

8.2 Standards for Protection of Cardmember Information

8.3 Data Incident Management Obligations

8.4 Indemnity Obligations for a Data Incident

8.5 Periodic Validation of Merchant Systems

9 Fraud Prevention

9.1 Introduction

9.2 Transaction Process

9.3 Strategies for Deterring Fraud

9.4 Card Acceptance Policies

9.5 Card Security Features

9.6 Recognizing Suspicious Activity

9.7 Fraud Mitigation Tools

9.8 Verification Services

9.9 American Express SafeKey

10 Risk Evaluation

10.1 Introduction

10.2 Prohibited and Restricted Merchants

10.3 Monitoring

10.4 Consumer Protection Monitoring Program

11 Chargebacks and Inquiries

11.1 Introduction

11.2 Transaction Process

11.3 Disputed Charge Process

11.4 Requesting a Chargeback Reversal

11.5 Resubmission of Disputed Charge

11.6 Compelling Evidence

11.7 Substitute Charge Records

11.8 Deadline for Responding

11.9 Cardmember Re-disputes

11.10 Chargeback and Inquiry Monitoring

11.11 How We Chargeback

11.12 Chargeback Programs

11.13 Ways to Receive Chargebacks and Inquiries

11.14 Response Methods

12 Merchant Fees

12.1 Introduction

12.2 Types of Fees

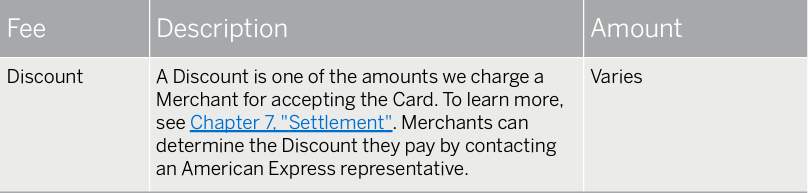

12.2.1 Card Acceptance Discount Fees

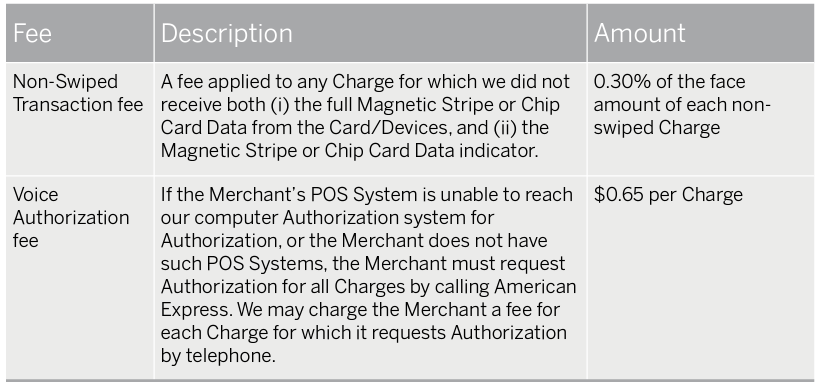

12.2.2 Authorization Fees

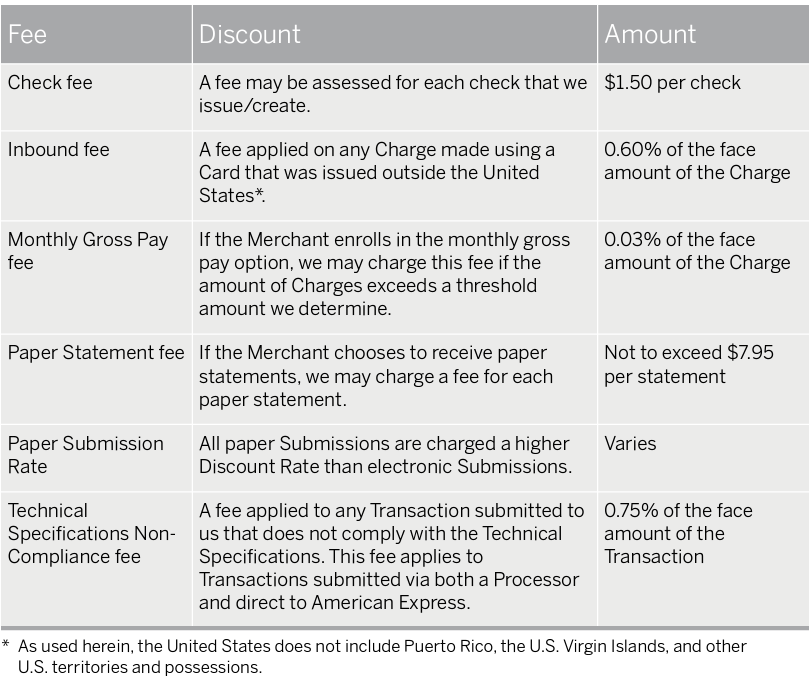

12.2.3 Submission and Settlement Fees

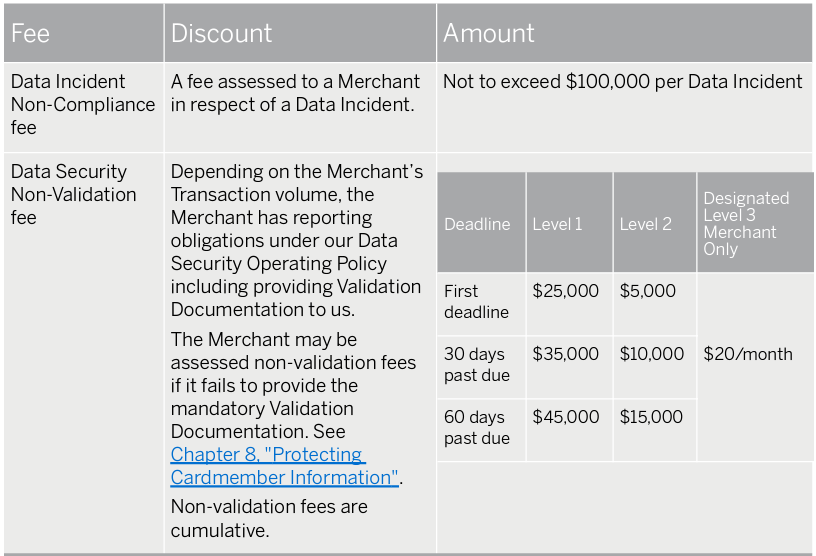

12.2.4 Data Security Fees

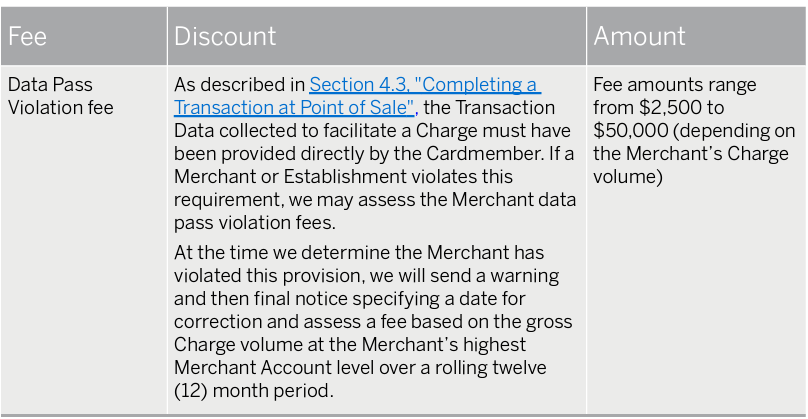

12.2.5 Data Pass Violation Fee

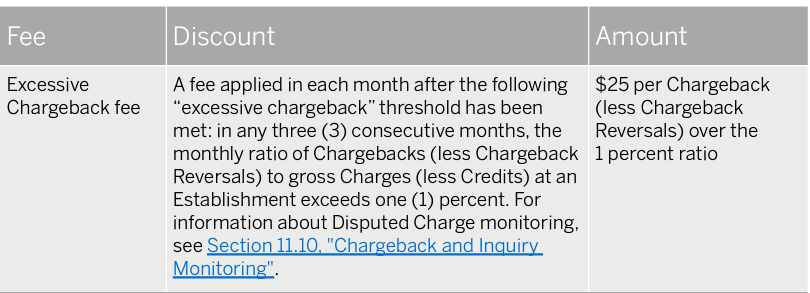

12.2.6 Excessive Chargeback Fee

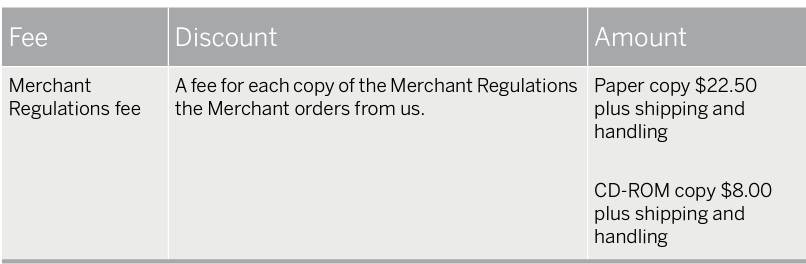

12.2.7 American Express Merchant Regulations Fee

Glossary

Introduction

1.1 About American Express

1.2 About the Reference Guide

1.3 Organization of the Reference Guide

1.4 Publishing Schedule

1.5 Becoming an American Express Merchant

October 2020: This document contains sensitive, confidential, and trade secret information, and must not be disclosed to third parties without the express prior written consent of American Express Travel Related Services Company, Inc.

1.1 About American Express

American Express was established more than 150 years ago and has undergone remarkable changes over the years. One characteristic has remained constant, however: our commitment to the core values of our founders. American Express is guided by a value system that is steadfastly focused on doing business in more than 130 countries around the globe with trust and integrity, delivering quality products and services to our valued customers. As a world-recognized brand leader, we take our commitment to Merchants seriously. This guide is designed to provide information about American Express and how accepting the American Express® Card can benefit Merchants.

1.2 About the Reference Guide

We are pleased to provide the American Express Merchant Reference Guide – U.S. which describes in general American Express’ standard policies and procedures for Card acceptance. This is a general review of information already distributed to Merchants in their Agreements with American Express governing acceptance of the Card; it does not change the terms and conditions of a particular Merchant’s Card acceptance Agreement. Some Merchants may have different or additional, or reformatted terms and conditions. In the event of any conflict between the Agreement and any Applicable Law, the requirements of the law govern.

1.3 Organization of the Reference Guide

The American Express Merchant Reference Guide is designed to follow the flow of the Transaction process – from Card acceptance, to Authorization, to Submission, to Settlement, to Disputed Charges, to Chargebacks.

1.4 Publishing Schedule

The American Express Merchant Reference Guide will change periodically. We reserve the right to make changes at any time, and it is possible that this information will not be accurate or current at all times or in all respects.

1.5 Becoming an American Express Merchant

If interested in becoming an American Express Merchant, call 800-445-2639, or visit www.americanexpress.com/merchant.

Doing Business With American Express

2.1 Introduction

2.2 The American Express Merchant Number

2.3 Merchant Information

2.4 Use of Third Parties

2.5 Compliance with the Technical Specifications

2.6 Call Monitoring

2.7 Permitted Uses

2.8 Cardmember Offers

2.9 Marketing Programs

2.1 Introduction

At American Express, we feel privileged to do business with Merchants and want to help make the process of accepting our Cards as simple as possible. This chapter outlines some general concepts that relate to doing business with American Express.

2.2 The American Express Merchant Number

American Express Merchant Numbers are provided to Merchants shortly after the application process to accept the Card is completed. Merchants must use their Merchant Numbers to identify their businesses any time they contact us. The Merchant is responsible for safeguarding the Merchant Number. Merchants must have separate Merchant Numbers assigned for Card Present Charges and Card Not Present Charges, respectively.

2.3 Merchant Information

Seamless communication is a critical component of our ability to provide superior service to our Merchants. Merchants must notify American Express of any changes in their Merchant information (e.g., changes in methods of doing business). Additionally, we require that Merchants provide us accurate information to identify each person or Entity applying to accept the Card and open a Merchant Account, as well as information that may be provided in subsequent calls or interactions with us. We will use such information to improve our services, prevent fraud, or for other business purposes.

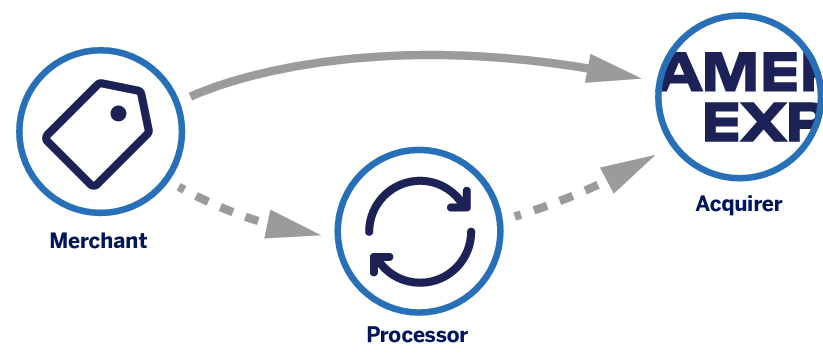

2.4 Use of Third Parties

Some Merchants choose to deal directly with American Express for all aspects of the

Transaction process; others enlist the assistance of various third parties to provide them with services. These third parties include:

- service providers/Processors,

- Terminal Providers,

- vendors, and

- Covered Parties and other agents contracted to operate on the Merchant’s behalf.

Merchants may retain, at their expense, such third parties; however, Merchants remain financially and otherwise liable for all obligations (including confidentiality obligations and compliance with the Technical Specifications), services, and functions they perform under the Agreement for Merchants, such as the technical requirements of authorizing and submitting Transactions to American Express, as if Merchants performed such obligations, services, and functions. Merchants must notify us if they intend for these third parties to deal directly with us and notify us promptly in writing if they change such third parties.

2.5 Compliance with the Technical Specifications

A vast number of Transactions traverse and are processed by the American Express Network. Merchants, Processors, Terminal Providers, and others must conform to the Technical Specifications in order to connect to and transact on the Network. Merchants must ensure that they and any third parties they enlist to facilitate Transaction processing with us comply with the Technical Specifications. Valid and accurate data must be provided for all data elements in accordance with the Technical Specifications. Failure to comply with the Technical Specifications may impact a Merchant’s ability to successfully process Transactions, and may result in non-compliance fees (see Subsection 12.2.3, “Submission and Settlement Fees”). Information regarding requirements for Merchant’s Point of Sale (POS) devices is available at www.americanexpress.com/merchantspecs, under Technical Mandates.

2.6 Call Monitoring

We will monitor or record (or both) and analyze telephone calls with Merchants to improve our services, prevent fraud, or for other business purposes.

2.7 Permitted Uses

In connection with Merchants’ acceptance of the Card, we may include Merchant’s name, address (including Merchant’s website addresses or URLs), customer service telephone numbers, and/or industry classification in lists of Merchants that accept the Card based on information Merchants have provided to us or that is otherwise publicly available.

2.8 Cardmember Offers

American Express wants to help encourage Cardmembers to seek out and shop at our small Merchants. From time to time, American Express may include small Merchants in Cardmember offers from American Express. For more information, visit www.americanexpress.com/us/small-business/shop-small/faqs and click on the Cardmember Offers tab.

2.9 Marketing Programs

As a Merchant, you may be eligible to participate in American Express marketing programs that we conduct from time to time. We have the right, in our sole discretion, whether or not to approve you as an eligible Merchant for a marketing program. If we determine that you are eligible for a marketing program, you have the right, in your sole discretion, to decide whether you will elect to participate in such a marketing program. If you do elect to participate in such marketing program, you must complete and sign the appropriate documentation and the provisions of the marketing sections will govern your participation in such programs.

Card Acceptance

3.1 Accepting the Card

3.2 Treatment of the American Express Brand

3.3 Prohibited Uses of the Card

3.4 Treatment of American Express Cardmember Information

3.1 Accepting the Card

Merchants must accept the Card as payment for goods and services (other than those goods and services prohibited under Section 3.3, “Prohibited Uses of the Card”) sold, or (if applicable) for charitable contributions made at all Establishments, except as expressly permitted by applicable state statute. Merchants are jointly and severally liable for the obligations of their Establishments under the Agreement.

3.2 Treatment of the American Express Brand

American Express has built a brand that is synonymous with trust, integrity, security, quality, and customer service. We work diligently to uphold our reputation and restrict Merchants from engaging in activities that would harm our business or brand. Except as expressly permitted by Applicable Law, Merchants must not:

- indicate or imply that they prefer, directly or indirectly, any Other Payment Products over our Card,

- try to dissuade Cardmembers from using the Card,

- criticize or mischaracterize the Card or any of our services or programs,

- try to persuade or prompt Cardmembers to use any Other Payment Products or any other method of payment (e.g., payment by check),

- impose any restrictions, conditions, disadvantages, or fees when the Card is accepted that are not imposed equally on all Other Payment Products, except for electronic funds transfer, or cash and check,

- suggest or require Cardmembers to waive their right to dispute a Transaction,

- engage in activities that harm our business or the American Express Brand (or both),

- promote any Other Payment Products (except the Merchant’s own private label card that they issue for use solely at their Establishments) more actively than the Merchant promotes our Card, or

- convert the currency of the original sales Transaction to another currency when requesting

Authorization or submitting Transactions (or both).

Merchants may offer discounts or in-kind incentives from their regular prices for payments in cash, ACH funds transfer, check, or debit card or credit/charge card, provided that (to the extent required by Applicable Law): (i) they clearly and conspicuously disclose the terms of the discount or in-kind incentive to their customers, (ii) the discount or in-kind incentive is offered to all of their prospective customers, and (iii) the discount or in-kind incentive does not differentiate on the basis of the Issuer or, except as expressly permitted by applicable state statute, payment card network (e.g., Visa, MasterCard, Discover, JCB, American Express). The offering of discounts or in-kind incentives in compliance with the terms of this paragraph will not constitute a violation of the provisions set forth above in this Section 3.2, “Treatment of the American Express Brand”.

Whenever payment methods are communicated to customers, or when customers ask what payments are accepted, Merchants must indicate their acceptance of the Card and display our Marks according to our guidelines and as prominently and in the same manner as any Other Payment Products. The Merchant must not use our Marks in any way that injures or diminishes the goodwill associated with the Mark, nor in any other way (without our prior written consent) indicate that we endorse the Merchant’s goods or services. The Merchant shall only use our Marks as permitted by the Agreement and shall cease using our Marks upon termination of the Agreement.

3.3 Prohibited Uses of the Card

Merchants must not accept the Card for any of the following:

- adult digital content sold via Internet Electronic Delivery,

- amounts that do not represent bona fide sales of goods or services (or, if applicable, amounts that do not represent bona fide charitable contributions made) at the Merchant’s Establishments,

- amounts that do not represent bona fide, direct sales by the Merchant’s Establishments to Cardmembers made in the ordinary course of their business,

- amounts that represent repayment of a cash advance including, but not limited to, payday loans, pawn loans or payday advances,

- cash or cash equivalent; for example, purchases of gold, silver, platinum and palladium bullion and/or bars (collectible coins and jewelry are not prohibited), or virtual currencies that can be exchanged for real currency (loyalty program currencies are not prohibited),

- Charges that the Cardmember has not specifically approved,

- costs or fees over the normal price of goods/services (plus applicable taxes) that the Cardmember has not specifically approved,

- damages, losses, penalties, or fines of any kind,

- gambling services (including online gambling), gambling chips, or gambling credits; or lottery tickets,

- unlawful/illegal activities, fraudulent business transactions, or when providing the goods or services is unlawful/illegal (e.g., unlawful/illegal online internet sales of prescription medications or controlled substances; sales of any goods that infringe the rights of a Rights-holder under laws applicable to us, you, or the Cardmember),

- overdue amounts, or amounts covering returned, previously dishonored, or stop-payment checks,

- sales made by third parties or Entities conducting business in other industries, or

- other items of which we notify the Merchant.

Merchants must not use the Card to verify a customer’s age.

3.4 Treatment of American Express Cardmember Information

Cardmember Information is confidential and the sole property of the Issuer, American Express or its Affiliates.

Merchants generally must not disclose Cardmember Information, nor use nor store it, other than to facilitate Transactions at their Establishments in accordance with the Agreement. For more information, see Section 4.3, “Completing a Transaction at Point of Sale”. For more information about protecting Cardmember Information, see Chapter 8, “Protecting Cardmember Information”

Processing

4.1 The Many Types of Transactions

4.2 Transaction Process

4.3 Completing a Transaction at Point of Sale

4.4 Processing an In-person Charge

4.5 Customer Activated Terminals

4.6 Processing a Card Not Present Charge

4.7 Processing a Credit

4.8 Digital Wallet Payment

4.9 Return and Cancellation Policies

4.10 Corporate Purchasing Card Charges

4.11 Advance Payment Charges

4.12 Aggregated Charges

4.13 Delayed Delivery Charges

4.14 Recurring Billing Charges

4.15 Processing Prepaid Cards

4.16 Processing Travelers/Gift Cheques

4.17 Property Damages to Accommodations and other Rentals

4.1 The Many Types of Transactions

In today’s marketplace, point of sale Transactions encompass a wide variety of customer options, including:

- in-store Transactions

- internet/e-commerce Transactions

- Application-initiated Transactions

- phone/mail order Transactions

- Customer Activated Terminal (CAT) Transactions

This chapter addresses Transaction processing and offers specific procedures for dealing with various Transaction types.

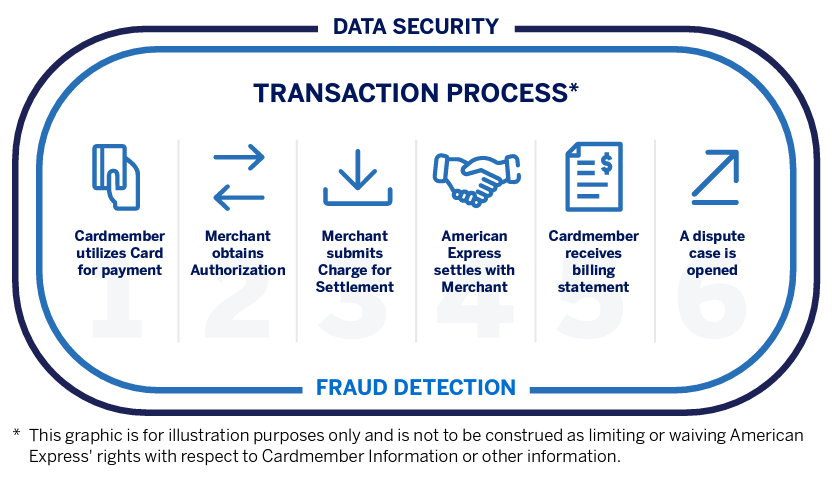

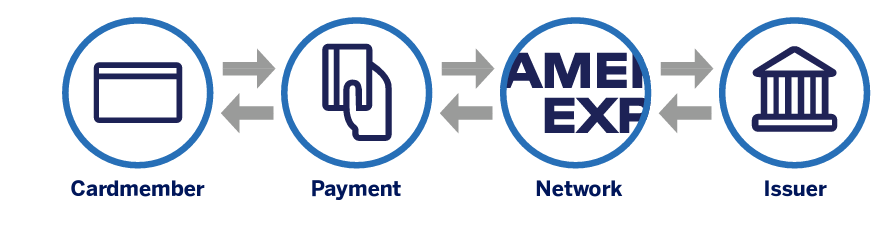

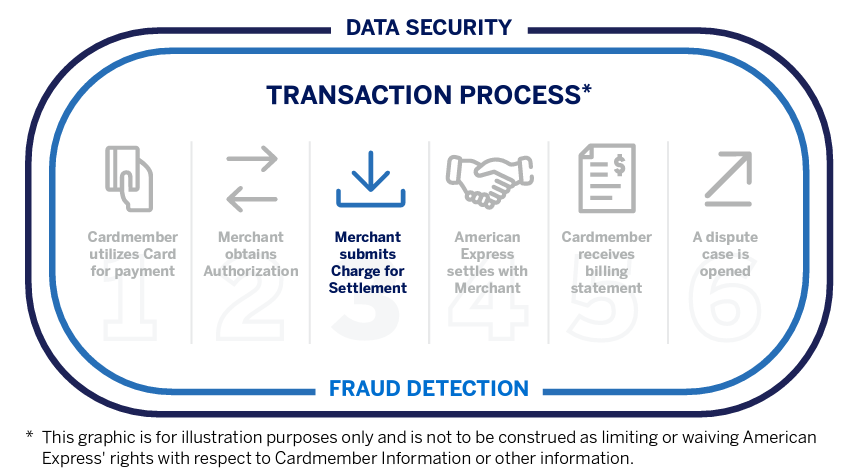

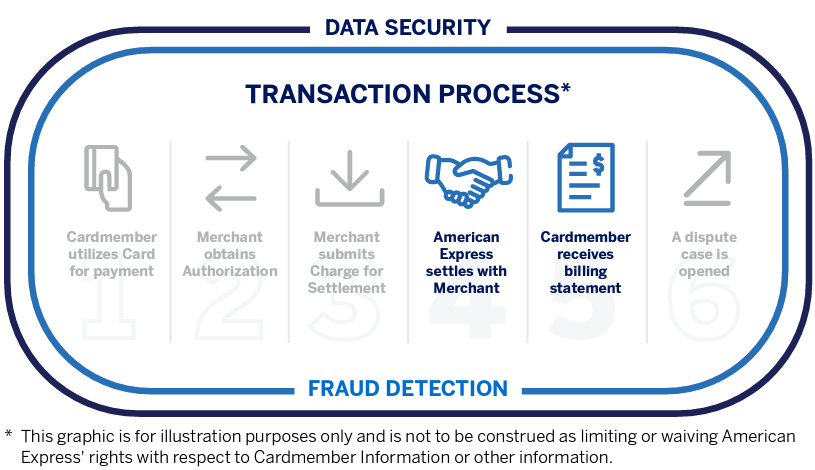

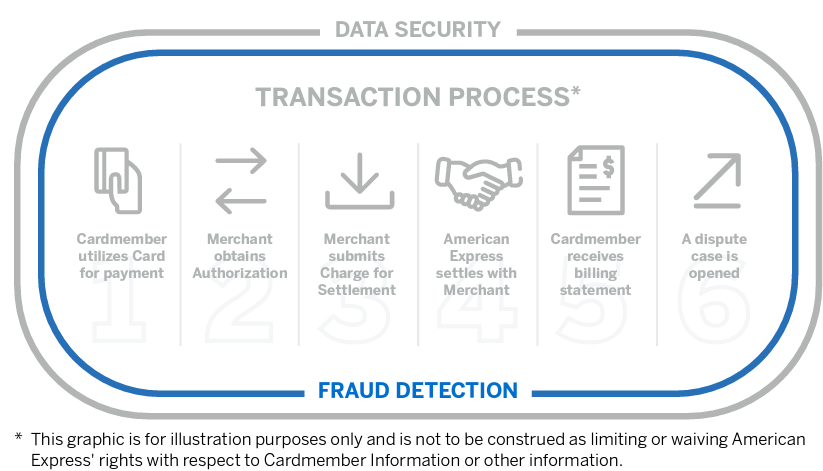

4.2 Transaction Process

The first step in understanding the Card acceptance process is to understand the American Express Transaction process. We will refer to this Transaction process at various points throughout the Reference Guide.

4.3 Completing a Transaction at Point of Sale

All valid Transactions begin with a Cardmember’s purchase at the point of sale. Whether the physical Card is used to facilitate a Card Present Charge, or the Cardmember provides his or her Cardmember Information over the phone, via mail order, or the internet, the Transaction must not be completed without the Card and/or information provided by the Cardmember. To accept the Card for Charges at an Establishment, at the point of sale, generally the Merchant must clearly and conspicuously disclose all material terms of the sale and inform the Cardmember at all points of interaction what Entity is making the sales offer so that he or she can distinguish the Merchant from any other parties involved in the sales offer. The Transaction Data a Merchant collects to facilitate the Charge must be, or have been, provided directly to the Merchant by the Cardmember. Failure to meet this requirement may subject the Merchant to data pass violation fees, as described in Subsection 12.2.5, “Data Pass Violation Fee”

4.4 Processing an In-person Charge

In-Person Charges refer to Charges in which the Card and Cardmember are present at the point of sale. An example of this is when a Cardmember presents a Card to a Merchant at a retail store.

There are two types of In-Person Charges:

- electronic Charges, which can be conducted in a variety of ways depending on the type of Card presented.

- key-entered Charges.

Merchants must conduct In-Person Charges and follow Card acceptance procedures according to the type of In-Person Charge and Card presented. For example, Merchants must:

- verify that the Card is not visibly altered or mutilated,

- capture Card Data,

- obtain an Authorization Approval,

- instruct the Cardmember to enter the PIN, if applicable, or obtain signature (optional) (except for Prepaid Cards that do not show a name on their face),

- match the Card Number and Expiration Date on the Card to the same information on the Charge Record,

- verify the Card’s Expiration Date, and

- validate the Card’s presence (key-entered Charges only).

If a Merchant chooses or is required by Applicable Law to obtain a Cardmember signature on a manual imprint, printed, or electronic Card Present Charge, the Merchant must:

- Obtain signature and verify that the signature is identical to the name on the Card*, and

- Compare the signature (when obtained) on the Charge Record with the signature on the Card.

- * Except when the Cardmember name is not captured on the Charge Record or for Prepaid Cards that do not show a name on their face.

This list is not exhaustive and we may, at our sole discretion, modify Card acceptance procedures.

4.5 Customer Activated Terminals

We generally accept Charges for purchases at Customer Activated Terminals (CATs) or payment kiosks.

4.6 Processing a Card Not Present Charge

Mail orders, telephone orders, and Internet Orders increase business opportunities, but such Card Not Present Charges do not provide the opportunity to inspect the physical Card. For Card Not Present Charges, the Merchant must create a Charge Record and ask the Cardmember to provide the following:

- Card Number or Token, and

- Card or Token Expiration Date.

In addition, we also recommend that Merchants ask for:

- name as it appears on the Card,

- Cardmember’s full billing address, and

- ship-to address, if different from the Cardmember’s full billing address.

Key-entered Charges are subject to a fee. See Subsection 12.2.2, “Authorization Fees”. If a Merchant accepts Card Present Transactions and also accepts payments via the internet, the Merchant must notify American Express so that we may assign a separate Merchant Number for the internet Transactions.

4.7 Processing a Credit

If you issue a Credit, we will not refund the Discount or any other fees or assessments previously applied on the corresponding Charge.

4.8 Digital Wallet Payment

When presented with a Mobile Device for a Charge, Merchants must follow our requirements specific to that type of Transaction including compliance with our most current contactless POS System requirements.

4.9 Return and Cancellation Policies

The Merchant’s return and cancellation policies must be fair and clearly disclosed at the time of purchase prior to completion of the Charge and in compliance with Applicable Law.

4.10 Corporate Purchasing Card Charges

In order to participate in our Corporate Purchasing Card (CPC) program (if applicable), Merchants must capture additional or reformatted Card Data on the Charge Record, and Transmission Data on the Transmissions, according to the Technical Specifications.

4.11 Advance Payment Charges

For certain purchases, Merchants may accept the Card for Advance Payment Charges. An Advance Payment Charge is a Charge for which full payment is made in advance of the Merchant providing the goods and/or rendering the services to the Cardmember.

4.12 Aggregated Charges

Merchants we classify in an internet industry may accept the Card for Aggregated Charges. An Aggregated Charge combines multiple small purchases or refunds (or both) incurred on a Card into one single Charge.

4.13 Delayed Delivery Charges

Merchants may accept the Card for Delayed Delivery Charges. A Delayed Delivery Charge is a single purchase for which the Merchant must create and submit two separate Charge Records. The first Charge Record is for the deposit or down payment and the second Charge Record is for the balance of the purchase.

4.14 Recurring Billing Charges

Recurring Billing is an option offered to Cardmembers to make recurring Charges automatically on their Card. The Recurring Billing Charges are for a product or service the Cardmember agrees to pay periodically and automatically (e.g., membership fees to health clubs, magazine subscriptions, and insurance premiums). If a Merchant offers Cardmembers the option to make Recurring Billing Charges, generally the Merchant must clearly and conspicuously disclose all material terms of the option including permission to receive updated Card account information and all cancellation policies, obtain the Cardmember’s express written consent prior to billing, and provide confirmation after the first Recurring Billing Charge. If the material terms of the option change, the Merchant must notify the Cardmember and obtain express written consent to the new terms. If the Recurring Billing Charge amounts vary, the Merchant must offer the Cardmember the right to receive notification of the amount and date of each Recurring Billing Charge.

4.15 Processing Prepaid Cards

Prepaid Cards are available for a variety of uses: gifting, travel, incentive, etc. All American Express Prepaid Cards show the American Express “Blue Box” logo either on the face or back of the Prepaid Card. Prepaid Cards may or may not be embossed. Most Prepaid Cards can be used for both in-store and online purchases. Prepaid Cards are valid through the date on the Card. Follow the relevant Card acceptance procedures when presented with a Prepaid Card at the point of sale just like any other Card. A Prepaid Card must be tendered for an amount that is no greater than the funds available on the Card.

4.16 Processing Travelers/Gift Cheques

American Express Travelers Cheques, Cheques for Two, and Gift Cheques are easy to accept provided that the cheque is an authentic American Express Travelers Cheque. Businesses can accept these Cheques for payment. Merchants can deposit Travelers Cheques, Cheques for Two and Gift Cheques directly into their Bank Account as they never expire. American Express Travelers Cheques are a widely used and recognized travel currency. If they are ever lost or stolen, they can be replaced quickly and easily, almost anywhere in the world, usually within twenty-four (24) hours.

4.17 Property Damages to Accommodations and other Rentals

Merchants we classify in a lodging accommodation, cruise line accommodations, trailer parks and campground rental, motor home rental, boat rental, aircraft rental, bicycle rental, motorcycle rental, or equipment rental industry may accept the Card to pay for Property Damage Fees and/or smoking fees. Cardmembers must expressly consent to the charges and other conditions apply.

Authorization

5.1 Introduction

5.2 Transaction Process

5.3 The Purpose of Authorization

5.4 Authorization Process

5.5 Possible Authorization Responses

5.6 Obtaining an Electronic Authorization

5.7 Obtaining a Voice Authorization

5.8 Card Identification (CID) Number

5.9 Authorization Reversal

5.10 Authorization Time Limit

5.11 Floor Limit

5.1 Introduction

The payment card industry devotes significant amounts of time and resources to developing Authorization systems and decision models in an effort to mitigate the financial losses. Every Transaction begins and ends with the Cardmember. Between the time the Cardmember presents the Card for payment and receives the goods or services, however, a great deal of data is exchanged, analyzed and processed. A process that literally takes seconds at the point of sale is actually a highly complex approach to analyzing each Transaction.

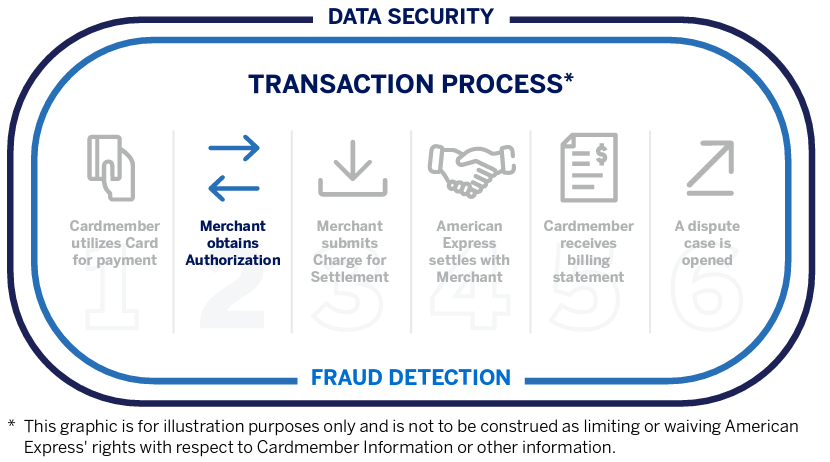

5.2 Transaction Process

For all Charges, Merchants must initiate an Authorization. The Authorization process begins when a Merchant provides an Authorization request to us. After requesting Authorization, Merchants receive an Authorization response, which they use, in part, to determine whether to proceed with the Charge.

5.3 The Purpose of Authorization

The purpose of an Authorization is to provide the Merchant with information that will help them to determine whether or not to proceed with a Charge. For every Charge, the Merchant is required to obtain an Authorization Approval. The Authorization Approval must be for the full amount of the Charge except for Merchants that we classify in the restaurant industry and certain Charges from Merchants we classify in the cruise line, lodging, vehicle rental, taxicab and limousine industries, and Card Not Present Retail and Grocery.

An Authorization Approval does not guarantee that (i) the person making the Charge is the Cardmember, (ii) the Charge is in fact valid or bona fide, (iii) the Merchant will be paid for the Charge, (iv) the Merchant will not be subject to a Chargeback, or (v) the Charge you submit will not be rejected.

5.4 Authorization Process

5.5 Possible Authorization Responses

Responses to a Merchant’s requests for Authorization are generated by Issuers and transmitted by us to the Merchant. The following are among the most commonly generated responses to a request for Authorization. The exact wording will vary.

- Approved

- Partially Approved

- Declined or Card Not Accepted

- Pick up

5.6 Obtaining an Electronic Authorization

Generally, Establishments must obtain an electronic Authorization. Merchants must ensure that all Authorization requests comply with the Technical Specifications (see Section 2.5, “Compliance with the Technical Specifications”). If the Authorization request does not comply with the Technical Specifications, we may reject the Submission, we may exercise Chargeback, and we will have the right to assess non-compliance fees (see Subsection 12.2.3, “Submission and Settlement Fees”). Occasionally, obtaining an electronic Authorization may not be possible (e.g., due to POS Systems problems, System Outages and other disruptions of an electronic Charge). In these instances, the Merchant must validate the Card’s presence and obtain a Voice Authorization.

5.7 Obtaining a Voice Authorization

If a Merchant’s electronic POS System is unable to reach our Authorization system, or a Merchant does not have an electronic POS System, the Merchant may call us for an Authorization. We may assess a fee for each Charge for which a Merchant requests such Voice Authorization. See Subsection 12.2.2, “Authorization Fees”.

5.8 Card Identification (CID) Number

The Card Identification (CID) number provides an extra level of Cardmember validation and is part of the Authorization process. The CID number is printed on the Card. The number is four digits. If, during the Authorization, a response is received that indicates the CID number given by the person attempting the Charge does not match the CID number that is printed on the Card, reprompt the customer at least one more time for the CID number. If it fails to match again, the Merchant should follow its internal store policies. Note: CID numbers must not be stored for any purpose. They are available for real time Charges only. See Chapter 8, “Protecting Cardmember Information”.

5.9 Authorization Reversal

Merchants may reverse an Authorization for a corresponding Charge by initiating an Authorization reversal. After a Charge Record has been submitted to us, however, the Authorization cannot be canceled or changed.

5.10 Authorization Time Limit

An Authorization Approval is valid for seven (7) days, with limited exceptions.

5.11 Floor Limit

We maintain a zero-dollar Floor Limit on all Charges for our Merchants in the U.S., Puerto Rico, the U.S. Virgin Islands, or other U.S. territories and possessions. This means that we require an Authorization on all purchases, regardless of the amount.

Submission

6.1 Introduction

6.2 Transaction Process

6.3 Purpose of Submission

6.4 Submission Process

6.5 Submission Requirements – Electronic

6.6 Submission Requirements – Paper

6.7 How to Submit

6.1 Introduction

Since payment cannot occur until the Transactions are submitted, submitting Transactions daily is encouraged even though the Merchant has up to seven (7) days to do so.

6.2 Transaction Process

Merchants must submit Transactions to us, directly or through their Processor, usually at the end of a day.

6.3 Purpose of Submission

After we receive the Submission, either directly from a Merchant or from its Processor, we will process it and settle with the Merchant according to its payment plan, speed of payment and payment methods, as described in Chapter 7, “Settlement”.

6.4 Submission Process

6.5 Submission Requirements – Electronic

Merchants must submit Transactions electronically except under extraordinary circumstances. When Merchants transmit Transactions electronically, they must still complete and retain Charge and Credit Records. We may not accept Submissions that do not comply with the Merchant Regulations, including the Technical Specifications and have the right to assess non-compliance fees. See Subsection 12.2.3, “Submission and Settlement Fees”.

6.6 Submission Requirements – Paper

If under extraordinary circumstances (e.g., outdoor market places, taxis and limousine services), Merchants submit Transactions on paper, they must do so in accordance with our instructions. Fees may apply if the Merchant submits Transactions on paper. See Subsection 12.2.3, “Submission and Settlement Fees”.

6.7 How to Submit

In many cases, a Merchant’s POS System automatically processes the Transactions in Batches at the end of the day. On busy days, a Merchant’s Transaction volume may be greater than its POS System’s storage capability. Merchants should work with their Terminal Provider to determine storage capacity, then determine if Transactions will need to be submitted more than once each day (e.g., submit a Batch at mid-day and again in the evening).

Settlement

7.1 Transaction Process

7.2 Settlement Amount

7.3 Discount/Discount Rate

7.4 Method of Payment

7.5 Speed of Payment

7.6 Payment Options

7.7 Reconciliation Options

7.8 Payment Errors or Omissions

7.1 Transaction Process

Once we receive a Submission file from the Merchant, we begin the process of settling. The Settlement amount is determined by totaling the Submissions adjusted for applicable debits and credits.

7.2 Settlement Amount

The Merchant’s Settlement amount will be the face amount of Charges submitted from its Establishments, pursuant to the Agreement, less all applicable deductions, rejections, and withholdings, which include:

- Discount – as set forth in the Agreement

- Amounts the Merchant owes us or our Affiliates – as set forth in the Agreement

- Amounts for which we have Chargebacks

- Credits that the Merchant submits

7.3 Discount/Discount Rate

The Discount is an amount we charge a Merchant for accepting the Card. In addition to the Discount, we may charge the Merchant additional fees and assessments (see Chapter 12, “Merchant Fees” or as otherwise provided to you in writing by us). We may adjust any of these amounts and may change any other amount we charge the Merchant for accepting the Card.

7.4 Method of Payment

Merchants must participate in our electronic pay program. We will charge Merchants a fee for paying them by check. See Subsection 12.2.3, “Submission and Settlement Fees”. We will send payments for Charges from the Merchant’s Establishments in the United States electronically via ACH to a Bank Account that the Merchant designates at a bank in the United States that participates in ACH.

7.5 Speed of Payment

We offer a variety of different payment plans. Merchants may choose one of the following plans based on eligibility:

- One day payment plan

- Three day payment plan

- Fifteen day payment plan

- Thirty day payment plan

7.6 Payment Options

American Express offers Merchants two main payment options.

7.7 Reconciliation Options

Monthly electronic statements are the default reconciliation format provided by American Express. In addition, raw data reconciliations and paper statements can be used to reconcile your Merchant Account. Each format can be used separately or in combination with the other formats. We may assess a fee for each paper statement requested. See Subsection 12.2.3, “Submission and Settlement Fees”.

7.8 Payment Errors or Omissions

Merchants must notify us in writing of any error or omission in respect of their Discount or other fees or payments for Charges, Credits or Chargebacks within ninety (90) days of the date of the statement containing such claimed error or omission.

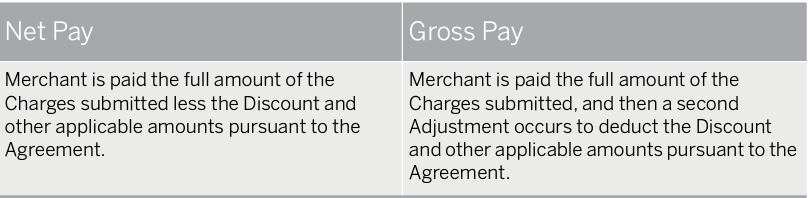

Net Pay Gross Pay

Merchant is paid the full amount of the Charges submitted less the Discount and other applicable amounts pursuant to the Agreement. Merchant is paid the full amount of the Charges submitted, and then a second Adjustment occurs to deduct the Discount and other applicable amounts pursuant to the Agreement.

Protecting Card Member Information

8.1 Data Security Operating Policy

8.2 Standards for Protection of Cardmember Information

8.3 Data Incident Management Obligations

8.4 Indemnity Obligations for a Data Incident

8.5 Periodic Validation of Merchant Systems

8.1 Data Security Operating Policy

As a leader in consumer protection, American Express has a long-standing commitment to protect Cardholder Data and Sensitive Authentication Data, ensuring that it is kept secure. Compromised data negatively affects consumers, Merchants, and Issuers. Even one incident can severely damage a company’s reputation and impair its ability to effectively conduct business. Addressing this threat by implementing security operating policies can help improve customer trust, increase profitability, and enhance a company’s reputation. The requirements of our Data Security Operating Policy apply to all equipment, systems, and networks and their components on which encryption keys, Cardholder Data, or Sensitive Authentication Data (or a combination of each) are stored, processed, or transmitted.

8.2 Standards for Protection of Cardmember Information

Merchants must, and they must cause their Covered Parties, to:

- store Cardholder Data only to facilitate American Express Card Transactions in accordance with, and as required by, the Agreement,

- comply with the current PCI DSS and other PCI SSC Requirements applicable to your processing, storing, or transmitting of Cardholder Data or Sensitive Authentication Data, no later than the effective date for implementing that version of the applicable PCI SSC Requirement,

- use, when deploying new or replacement PIN Entry Devices or Payment Applications (or both) in attended locations, only those that are PCI-Approved.

8.3 Data Incident Management Obligations

Merchants must notify American Express immediately and in no case later than twenty-four (24) hours after discovery of a Data Incident. To notify American Express, please contact the American Express Enterprise Incident Response Program (EIRP) toll free at 888.732.3750 (U.S. only), or at 1.602.537.3021 (International), or email at [email protected].

8.4 Indemnity Obligations for a Data Incident

Under the Agreement, Merchants’ indemnity obligations to American Express for a Data Incident are determined by a formula we provide for calculating compensation for costs and losses resulting from the Data Incident, including a non-compliance fee (for additional information, see Subsection 12.2.4, “Data Security Fees”) unless:

- the Merchant notified American Express according to the requirements in Section 8.3, “Data Incident Management Obligations”,

- the Merchant was in compliance at the time of the Data Incident with the PCI DSS (as determined by the PFI’s investigation of the Data Incident), and

- the Data Incident was not caused by the Merchant’s wrongful conduct or that of its Covered Parties.

8.5 Periodic Validation of Merchant Systems

Certain Merchants must take certain actions to demonstrate compliance with the PCI DSS, annually and quarterly. American Express has the right to impose non-validation fees on Merchants and terminate the Agreement if the Merchant does not fulfill these requirements or fails to provide the mandatory Validation Documentation to American Express by the applicable deadline. The fees for nonvalidation are outlined in Chapter 12, “Merchant Fees”.

Fraud Prevention

9.1 Introduction

9.2 Transaction Process

9.3 Strategies for Deterring Fraud

9.4 Card Acceptance Policies

9.5 Card Security Features

9.6 Recognizing Suspicious Activity

9.7 Fraud Mitigation Tools

9.8 Verification Services

9.9 American Express SafeKey

9.1 Introduction

We offer a full suite of premium value tools that can help to mitigate the chances of fraud on American Express Cards and reduce this cost to a Merchant’s business.

9.2 Transaction Process

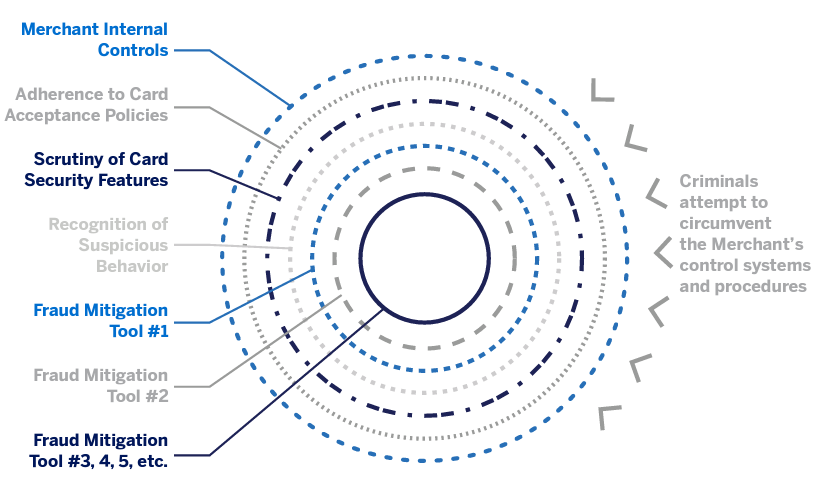

Our primary strategy for combating fraudulent Card use is to address it at the point of Authorization. While fraud usually is thought of as a deceptive act at the point of sale, detection can actually occur during any stage in the Transaction process.

9.3 Strategies for Deterring Fraud

We recommend implementing multiple layers of fraud protection to help secure the Merchant’s business. These layers may include a combination of the Merchant’s point of sale procedures and controls as well as implementation of fraud mitigation tools.

American Express is committed to working with Merchants to deploy tools that can help reduce the likelihood that fraudulent Charges will be Approved. The implementation and use of the strategies and tools, however, does not guarantee that (i) the person making the Charge is the Cardmember, (ii) the Charge is in fact valid or bona fide, (iii) the Merchant will be paid for the Charge, or (iv) the Merchant will not be subject to a Chargeback.

9.4 Card Acceptance Policies

A critical component in a Merchant’s overall fraud mitigation strategy is to follow our Card acceptance procedures. The additional layers of fraud mitigation mentioned previously can supplement this line of defense.

9.5 Card Security Features

In many cases, the physical appearance of the Card will offer the most obvious clues of fraudulent activity. Our Card security features are designed to help Merchants assess whether a Card is authentic or has been altered. Ensure that all personnel are familiar with our Card’s security features so they can identify potentially compromised Cards.

9.6 Recognizing Suspicious Activity

Diligently scrutinizing behaviors and circumstances can help prevent Merchants from being victimized by fraud. Merchants must always be aware of circumstances that may indicate a fraudulent scheme or suspicious behavior that may flag a fraudulent Cardmember.

Suspicious Behavior

A suspicious situation may arise, causing the Merchant to question the authenticity of the Card, or the legitimacy of the person presenting it. If a Merchant suspects Card misuse, they should follow their internal store policies. Merchants should never put themselves or their employees in unsafe situations, nor physically detain or harm the holder of the Card.

9.7 Fraud Mitigation Tools

We offer fraud mitigation tools for both Card Present and Card Not Present Transactions to help verify that they are valid. These tools help Merchants mitigate the risk of fraud at the point of sale, but are not a guarantee that (i) the person making the Charge is the Cardmember, (ii) the Charge is in fact valid or bona fide, (iii) the Merchant will be paid for the Charge, or (iv) the Merchant will not be subject to a Chargeback.

9.8 Verification Services

We also offer tools that help Merchants evaluate the validity of a Charge by comparing information provided by the customer at the point of sale with information on file with the Issuer. These verification tools are available for both Card Present and Card Not Present Charges, and can be used in multiple layers simultaneously to help the Merchant mitigate the risk of fraud. However, our verification tools are not a guarantee that (i) the person making the Charge is the Cardmember, (ii) the Charge is in fact valid or bona fide, (iii) the Merchant will be paid for the Charge, or (iv) the Merchant will not be subject to a Chargeback.

9.9 American Express SafeKey

The American Express SafeKey® Program (the AESK program) enables Merchants to verify Cardmembers during the online authentication process in order to help reduce the likelihood of American Express Card fraud.

Risk Evaluation

10.1 Introduction

10.2 Prohibited and Restricted Merchants

10.3 Monitoring

10.4 Consumer Protection Monitoring Program

10.1 Introduction

Merchants understand the hard work and dedication it takes to keep a business running. At American Express, we also work hard to maintain our business and uphold our reputation as a world-class global payments and network company. Part of our regimen is to evaluate Merchants to ensure compliance with our policies and procedures, in addition to assessing any potential risk to our business.

10.2 Prohibited and Restricted Merchants

Some Merchants, and/or some of their Establishments, are not eligible (or may become ineligible) to accept the Card. We may suspend acceptance of Cards by you or any of your Establishments or terminate the Agreement (including immediate termination without prior notice to you) if we determine or have reason to believe, in our sole discretion, that the Merchant is performing a prohibited activity, or that the Merchant is failing to comply with our policies and procedures and/or the Merchant’s actions or behaviors (or both) pose any potential risk to our business.

10.3 Monitoring

After a Merchant joins our Network, we monitor to identify potential risks, assess financial status and compliance with the Agreement. Based on the results of our monitoring, we reserve the right to take action to mitigate our risk,

including one or more of the following (in our sole judgment):

- requesting information about the Merchant’s finances and operations,

- instituting Card acceptance restrictions,

- exercising Chargeback, rejecting Charges or withholding Settlements,

- charging fees or assessments to the Merchant Account,

- requiring corrective action by the Merchant,

- terminating any Establishment’s Card acceptance privileges or suspending those privileges until the risk has subsided, or

- terminating the Agreement and the Merchant Account.

10.4 Consumer Protection Monitoring Program

American Express monitors the Network for fraudulent, deceptive, and unfair practices relating to the sale, advertising, promotion, or distribution of goods or services to consumers. If we determine or have reason to believe, in our sole discretion, that a Merchant engages or has engaged (or knowingly participates or knowingly has participated) in such fraudulent, deceptive, or unfair practices, we may place the Merchant in our Consumer Protection Monitoring Program. If a Merchant is placed in the Consumer Protection Monitoring Program, we may suspend or refuse to allow Card acceptance at an Establishment, or terminate the Agreement.

Chargebacks and Inquiries

11.1 Introduction

11.2 Transaction Process

11.3 Disputed Charge Process

11.4 Requesting a Chargeback Reversal

11.5 Resubmission of Disputed Charge

11.6 Compelling Evidence

11.7 Substitute Charge Records

11.8 Deadline for Responding

11.9 Cardmember Re-disputes

11.10 Chargeback and Inquiry Monitoring

11.11 How We Chargeback

11.12 Chargeback Programs

11.13 Ways to Receive Chargebacks and Inquiries

11.14 Response Methods

11.1 Introduction

This chapter provides an overview on how American Express processes Chargebacks and Inquiries.

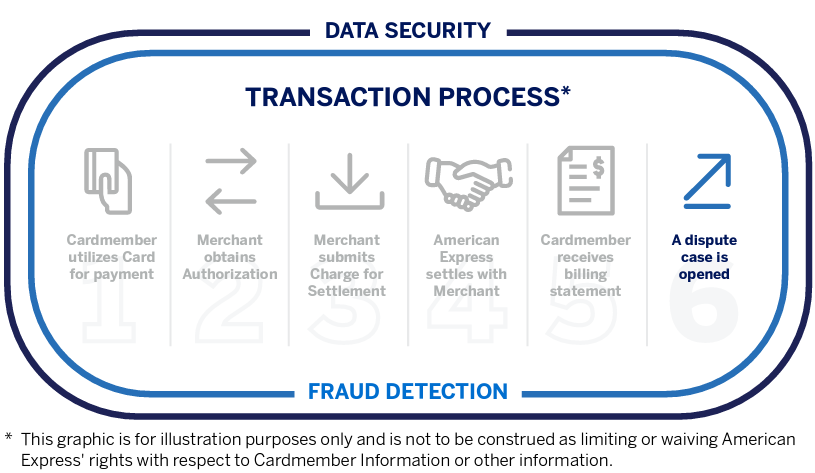

11.2 Transaction Process

Charges may be disputed for a variety of reasons. In general, most Disputed Charges stem from:

- Cardmember dissatisfaction with some aspect of the purchase, (e.g., a failure to receive the merchandise, duplicate billing of a Charge, incorrect billing amount),

- an unrecognized Charge where the Cardmember requests additional information, or

- actual or alleged fraudulent Transactions.

If a Cardmember disputes a Charge, American Express opens a case. We may also open cases when Issuers or the Network initiates disputes. If a case is opened, we may initiate a Chargeback to you immediately or send you an Inquiry. You must not suggest or require Cardmembers to waive their right to dispute any Transaction.

11.3 Disputed Charge Process

With respect to a Disputed Charge:

- we may send the Merchant an Inquiry prior to exercising Chargeback, or

- we have Chargeback rights, prior to sending the Merchant an Inquiry, if we determine that we have sufficient information to resolve the Disputed Charge in favor of the Cardmember.

We have Chargeback rights:

- whenever Cardmembers bring Disputed Charges, as described in this chapter, or have rights under the Applicable Law or contract to withhold payments,

- in cases of actual or alleged fraud relating to Charges,

- if the Merchant does not comply with the Agreement (including omitting any Transaction Data from Charge Submissions), even if we had notice when we paid the Merchant for a Charge that the Merchant did not so comply and even if the Merchant obtained Authorization for the Charge in question, or

- as provided elsewhere in the Agreement.

All judgments regarding resolution of Disputed Charges are at our sole discretion.

11.4 Requesting a Chargeback Reversal

Merchants may request a Chargeback Reversal if they provide the required supporting information. A Merchant must request the Chargeback Reversal no later than twenty (20) days after the date of the Chargeback. Additionally, if the Chargeback was preceded by an Inquiry, the Merchant must respond to the Inquiry within twenty (20) days.

11.5 Resubmission of Disputed Charge

Merchants must not re-submit a Disputed Charge after it has been resolved in favor of the Cardmember. We will Chargeback all such Disputed Charges that are resubmitted.

11.6 Compelling Evidence

Merchants may provide Compelling Evidence as support to demonstrate the Cardmember participated in the Transaction, received goods or services, or benefited from the Transaction. If the evidence is validated as meeting the Compelling Evidence policy, the Issuer will review the Compelling Evidence with the Cardmember prior to making a decision on the Chargeback reversal request. Merchants are expected to provide all available information, and to only submit Compelling Evidence when the Merchant strongly believes the Cardmember participated in the Transaction, received goods or services, or authorized the Charge.

11.7 Substitute Charge Records

In some cases, Merchants may provide a Substitute Charge Record as supporting documentation for Card Not Present Charges in place of the original Charge Record. Merchants must also provide any additional information requested in the Inquiry.

11.8 Deadline for Responding

Merchants must respond in writing within twenty (20) days following our Inquiry and provide the requested information and other supporting documentation.

11.9 Cardmember Re-disputes

We may reinvestigate an Inquiry if a Cardmember provides new or additional information after we review the initial supporting documentation regarding a Disputed Charge. In such case, Merchants will be required to provide additional information to support the validity of the Charge.

11.10 Chargeback and Inquiry Monitoring

American Express monitors the number of Chargebacks and Inquiries at all Merchants and Establishments on the Network. If the number of Chargebacks and/or Inquiries at a Merchant or Establishment is considered disproportionate, we may take action to protect our interests.

11.11 How We Chargeback

We may Chargeback by (i) deducting, withholding, recouping from, or otherwise offsetting against our payments to a Merchant or debiting a Merchant’s Bank Account, or we may notify a Merchant of its obligation to pay us, which it must do promptly and fully; or (ii) reversing a Charge for which we have not paid the Merchant. In the event of a Chargeback, we will not refund the Discount or any other fees or assessments, or we will otherwise recoup such amounts from a Merchant. Our failure to demand payment does not waive our Chargeback rights.

11.12 Chargeback Programs

Certain Chargebacks arise because Merchants are in the following Chargeback programs. We may place Merchants in any of these programs any time during the term of the Agreement.

- Immediate Chargeback Program

- Partial Immediate Chargeback Program

- Fraud Full Recourse Program

11.13 Ways to Receive Chargebacks and Inquiries

American Express has a variety of options for the exchange of Inquiry information with Merchants. In addition to the traditional paper by mail method, Merchants can receive and respond to Chargebacks and Inquiries by accessing their Merchant Account online, our preferred method of handling Chargebacks and Inquiries.

11.14 Response Methods

Merchants may respond to Inquiries via fax, mail, or by accessing their Merchant Account online.

Merchant Fees

12.1 Introduction

12.2 Types of Fees

12.1 Introduction

Merchants must pay us the Discount and they may be subject to various other fees and assessments. Some fees and assessments are for special products or services, while others may be applied because of a Merchant’s non-compliance with our policies and procedures. Many non-compliance fees and assessments can be avoided by correcting the actions that are causing the Merchant not to be in compliance.

12.2 Types of Fees

The Agreement imposes various fees and assessments, examples of which are described in the following tables.

12.2.1 Card Acceptance Discount Fees

12.2.2 Authorization Fees

12.2.3 Submission and Settlement Fees

12.2.4 Data Security Fees

12.2.5 Data Pass Violation Fee

12.2.6 Excessive Chargeback Fee

12.2.7 American Express Merchant Regulations Fee

Glossary

Adjustment

An American Express credit or debit to the Merchant Account.

Advance Payment Charge

A Charge for which full payment is made in advance of the Merchant providing the goods and/or rendering the services to the Cardmember.

Affiliate

Any Entity that controls, is controlled by, or is under common control with either party, including its subsidiaries. As used in this definition, “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of an Entity, whether through ownership of voting securities, by contract, or otherwise. For the avoidance of doubt, but not by way of limitation, the direct or indirect ownership of more than 50% of (i) the voting securities or (ii) an interest in the assets, profits, or earnings of an Entity shall be deemed to constitute “control” of the Entity.

Aggregated Charge

A Charge that combines multiple small purchases or refunds (or both) incurred on a Card into a single, larger Charge before submitting the Charge for payment.

Agreement

The agreement governing a Merchant’s acceptance of the Card.

American Express

American Express Travel Related Services Company, Inc., a New York corporation.

American Express Brand

The American Express name, trademarks, service marks, logos, and other proprietary designs and designations and the imagery owned by American Express or an American Express Affiliate and the goodwill associated with all of the foregoing and with all the goods and services now and in the future provided, marketed, offered, or promoted by American Express or an American Express Affiliate.

American Express Card or Cards

(i) Any card, account access device, or payment device or service bearing our or our Affiliates’ Marks and issued by an Issuer or (ii) a Card Number.

American Express Network or Network

The Network of Merchants that accept Cards and the operational, service delivery, systems, and marketing infrastructure that supports this Network and the American Express Brand.

American Express Quick Chip

A software solution that modifies the EMV®1 transaction flow for processing of American Express Cards, which allows a Chip Card to be inserted before the final Transaction amount is known, and does not require the Card to remain in the reader during the online Authorization process.

American Express SafeKey (AESK)

American Express SafeKey is an industry standard authentication tool that is designed to provide greater security for online Transactions.

Applicable Law

(i) Any law, statute, regulation, ordinance, or subordinate legislation in force from time to time to which you or we or an Affiliate of either is subject, (ii) the common law as applicable to them from time to time, (iii) any court order, judgment, or decree that is binding on them, and (iv) any directive, policy, rule, or order that is binding on them and that is made or given by a regulator or other government or government agency of any Territory, or other national, federal, commonwealth, state, provincial, or local jurisdiction.

Approval/Approved

A message granting an Authorization in response to a request for Authorization from a Merchant, consisting of an Approval or other indicator.

Application-Initiated Transaction

A Transaction initiated by an electronic device (including, but not limited to, a mobile telephone, tablet, or wearable device) utilizing a merchant software application within the electronic device.

Assured Reservation Program

The Assured Reservation Program allows Cardmembers to contact a participating property or rental agency to make an Assured Reservation and guarantee the reservation by giving their American Express Card. The Assured Reservation Program is available to the following industries: hotel, trailer park/campground, vehicle, aircraft, bicycle, boat, equipment, motor home, and motorcycle rentals.

Authorization/Authorized

The process by which a Merchant obtains an Approval for a Charge in accordance with the Agreement.

Bank Account

A deposit account (also known as a Demand Deposit Account, DDA or checking account) that a Merchant holds at a bank or other financial institution.

Batch

A group of Transactions, including Charges and Credits, submitted to American Express, usually on a daily basis.

Card

See “American Express Card or Cards”.

Card Data

Card Data includes the following elements: Cardmember name, Card Number, Expiration Date, Charge date, the amount of the Charge, the Approval, description of goods and services, Merchant name, Merchant address, Merchant Number and if applicable the Establishment number, Cardmember signature (if obtained), “No Refund” if the Merchant has a no refund policy and all other information as required from time to time by us or Applicable Law.

Card Identification (CID) Number

A four-digit number printed on the Card. See Section 5.8, “Card Identification (CID) Number”.

Card Not Present Charge

A Charge for which the Card is not presented at the point of sale (e.g., Charges by mail, telephone, fax or the internet).

Card Number

The unique identifying number that the Issuer assigns to the Card when it is issued.

Card Present Charge

A Charge for which the physical Card and Cardmember are present at the point of sale, including In- Person Charges and Charges made at CATs.

Cardholder Data

Has the meaning given in the then current Glossary of Terms for the PCI DSS.

Cardmember

An individual or Entity (i) that has entered into an agreement establishing a Card account with an Issuer or (ii) whose name appears on the Card.

Cardmember Information

Any information about Cardmembers and Transactions, including, but not limited to, Transaction Data, and Cardmember name, addresses, Card Numbers, and CID Numbers.

Charge

A payment or purchase made on the Card.

Charge Data

Data to be included in Submissions of Charge Records.

Charge Record

A reproducible (both paper and electronic) record of a Charge that complies with our requirements and that contains the Card Number, Transaction date, dollar amount, Approval, Cardmember signature (if applicable), and other information.

Chargeback

When used as a verb, means (i) our reimbursement from a Merchant for the amount of a Charge subject to such right, or (ii) our reversal of a Charge for which we have not paid the Merchant; when used as a noun, means the amount of a Charge subject to reimbursement from a Merchant, or reversal. (Chargeback is sometimes called “full recourse” or “Full Recourse” in our materials.)

Chargeback Reversal

Removal of a previously posted Chargeback.

Chip

An integrated microchip embedded on a Card containing Cardmember and account information.

Compelling Evidence

Additional types of documentation provided by the Merchant to demonstrate the Cardmember participated in the Transaction, received goods or services, or benefited from the Transaction.

Consumer Protection Monitoring Program

Our program to monitor for fraudulent, deceptive, or unfair practices relating to the sale, advertising, promotion, or distribution of goods or services to consumers. See Section 10.4, “Consumer Protection Monitoring Program” for additional information.

Contactless

Technology enabling a Card or Mobile Device embedded with a radio frequency component (currently, Expresspay) to communicate with a radio frequency-enabled POS System to initiate a Transaction. See also “Expresspay”.

Corporate Purchasing Card (CPC)

The Corporate Purchasing Card program assists with procurement costs and enables streamlining of the procurement process from sourcing and buying, to billing payment and reconciliation.

Covered Parties

Any or all of your employees, agents, representatives, subcontractors, Processors, Service Providers, providers of your point-of-sale equipment, POS Systems, or payment processing solutions, Entities associated with your American Express Merchant Account, and any other party to whom you may provide Cardholder Data or Sensitive Authentication Data (or both) access in accordance with the Agreement.

Credit

The amount of the Charge that the Merchant refunds to Cardmembers for purchases or payments made on the Card.

Credit Record

A record of Credit that complies with our requirements.

Customer Activated Terminal (CAT)

An unattended POS System (e.g., gasoline pump, vending machine, check-out kiosk).

Data Incident

An incident involving at least one Card Number in which there is (i) unauthorized access or use of encryption keys, Cardholder Data, or Sensitive Authentication Data (or a combination of each) that are stored, processed, or transmitted on a Merchant’s equipment, systems, and/or networks (or the components thereof); (ii) use of such encryption keys, Cardholder Data, or Sensitive Authentication Data (or a combination of each) other than in accordance with the Agreement; and/or (iii) suspected or confirmed loss, theft, or misappropriation by any means of any media, materials, records, or information containing such encryption keys, Cardholder Data, or Sensitive Authentication Data (or a combination of each).

Data Security Operating Policy (DSOP)

The American Express data security policy, as described in Chapter 8, “Protecting Cardmember Information”.

Decline

A message from us denying the Merchant’s request for Authorization.

Delayed Delivery Charge

A single purchase for which the Merchant must create and submit two separate Charge Records. The first Charge Record is for the deposit or down payment and the second Charge Record is for the balance of the purchase.

Discount/Discount Rate

An amount that we charge a Merchant for accepting the Card, which amount is a percentage (Discount Rate) of the face amount of the Charge that the Merchant submits, or a flat per-Transaction fee, or a combination of both. See Subsection 12.2.1, “Card Acceptance Discount Fees”.

Disputed Charge

A Charge about which a claim, complaint, or question has been brought.

Entity

A corporation, partnership, sole proprietorship, trust, association, or any other legally recognized entity or organization.

Establishments

Any or all of a Merchant’s and its Affiliates’ locations, outlets, websites, online networks, and all other methods for selling goods and services, including methods that a Merchant adopts in the future.

Expiration Date

The month and year on which a Card expires (sometimes referred to as “valid thru” or ”active thru”date).

Expresspay

An American Express program that enables Contactless transactions.

Floor Limit

A monetary threshold amount for a single Charge, at or above which the Merchant must obtain an Authorization before completing the Charge.

Fraud Full Recourse Program

One of our Chargeback programs. See Section 11.12, “Chargeback Programs” for additional information.

Immediate Chargeback Program

One of our Chargeback programs. See Section 11.12, “Chargeback Programs” for additional information.

In-Person Charge

A Card Present Charge excluding Charges made at CATs (e.g., a Charge taken at a Merchant attended retail location where the Card is swiped, read by a contactless reader, inserted into a Chip Card reader or manually key-entered).

Inquiry

Our request for information about a Disputed Charge.

Internet Electronic Delivery

Delivery of goods or services purchased on the internet via an internet download or another file transfer process (e.g., images or software download).

Internet Order

Card payment information that is taken via the World Wide Web, online (usually via a website payment page), email, intranet, extranet, or other similar network in payment for merchandise or services.

Issuers

Any Entity (including American Express and its Affiliates) licensed by American Express or an American Express Affiliate to issue Cards and to engage in the Card issuing business.

Magnetic Stripe

A stripe on the back of a Card that contains Cardmember and account information in machine readable form.

Marks

Names, logos, service marks, trademarks, trade names, taglines, or other proprietary designs or designations.

Merchant

Any seller of goods or services, non-profit, or government Entity that enters into an Agreement with American Express or its licensees wherein the seller agrees to (i) permit any Cardmember to charge purchases of goods and services at or with such Merchant by means of the Card and (ii) transfer Transactions to American Express or its licensee. This term includes all Establishments (sometimes called “Service Establishments” or “SEs” in our materials).

Merchant Account

An account established by us upon entering into an Agreement with a Merchant.

Merchant Interactive (MI)

Our online tool that allows for reconciliation of payment, facilitates the resolution of Inquiries and Disputed Charges and provides Merchant reporting or, more generally, access to your Merchant Account online at www.americanexpress.com/merchant.

Merchant Number

A unique number we assign to the Merchant’s Establishment.

Mobile Device

An Issuer approved and American Express recognized electronic device (including, but not limited to, a mobile telephone).

Mobile Point of Sale (MPOS)

A generic term for a system comprising of a commercial off-the-shelf mobile computing device with cellular or Wi-Fi data connectivity (such as a phone, tablet, or laptop) that may be used in conjunction with a Card-reading peripheral to accept contact and/or Contactless Transactions.

Network

See “American Express Network or Network“.

Non-Credit Payment Forms

Any form of payment other than a (i) general purpose credit or charge card; or (ii) payment card brand name that references both general purpose credit or charge cards and debit cards, such as “Visa” or “MasterCard.”

Other Payment Products

Any charge, credit, debit, stored value, prepaid, or smart cards, account access devices, or other payment cards, services, or products other than the Card.

Partial Immediate Chargeback Program

One of our Chargeback programs. See Section 11.12, “Chargeback Programs” for additional information.

Payment Card Industry Security Standards Council (PCI SSC).

Requirements

The set of standards and requirements related to securing and protecting payment Card Data, including the PCI DSS and PA DSS, available at www.pcisecuritystandards.org.

Personal Identification Number (PIN)

A secret code for use with one or more American Express Network, Acquirer, or Issuer systems that is used to authenticate the user (e.g., a Cardmember) to that system.

Point of Sale (POS) System

An information processing system or equipment, including a terminal, personal computer, electronic cash register, contactless reader, Mobile Point of Sale (MPOS), or payment engine or process, used by a Merchant, to obtain Authorizations or to collect Transaction Data, or both.

Prepaid Card

A Card that is marked “Prepaid” or bearing such other identifiers used by American Express from time to time.

Processor

A service provider to Merchants who facilitates Authorization and Submission processing to the Network.

Recurring Billing

An option offered to Cardmembers to make recurring Charges automatically on their Card (e.g., membership fees to health clubs, magazine subscriptions, and insurance premiums).

Rights-holder

A natural or legal person or Entity having the legal standing and authority to assert a copyright or trademark right.

Sensitive Authentication Data

Has the meaning given in the then current Glossary of Terms for the PCI DSS.

Settlement

The process by which we compile the Merchant’s debits and credits to calculate a net amount that will be applied to the Merchant’s Bank Account (sometimes called “deposit” or “Deposit” in our materials).

Submission

The collection of Transaction Data that the Merchant sends to us.

Substitute Charge Record

A document created from original Transaction data.

System Outage

Interruption of either Merchant or American Express Network systems or services (e.g., computer system failure, telecommunications failure, or regularly scheduled downtime).

Technical Specifications

The set of mandatory, conditional, and optional requirements related to connectivity to the Network and electronic Transaction processing, including Authorization and Submission of Transactions, which we may update from time to time.

Terminal Provider

The Processor, vendor or company that provides the Merchant’s POS System.

Token

A surrogate value that replaces the Card Number.

Transaction

A Charge or Credit completed by the means of a Card.

Transaction Data

All information required by American Express evidencing one or more Transactions, including information obtained at the point of sale, information obtained or generated during Authorization and Submission, and any Chargeback.

Transmission

A method of sending Transaction Data to American Express, whereby Transaction Data is transmitted electronically over communication lines.

Transmission Data

The same as Card Data except for the requirements to include: Cardmember name, Expiration Date, the Cardmember’s signature (if obtained); and the words “No Refund” if the Merchant has a no refund policy.

Validation Documentation

Documents to be provided by Merchants under the Data Security Operating Policy. See Chapter 8, “Protecting Cardmember Information”.

Voice Authorization

The Authorization of a Charge obtained by calling the American Express Authorization Department.

we, our and us

American Express Travel Related Services Company, Inc.

[/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]